Effective July 1st 2018, a new Australian Goods and Services Tax (GST) will apply to the sale of “low value imported goods” to Australia. Low value imported goods (LVIG) are goods (not including tobacco products or alcohol) that have a customs value of Au$1,000 or less when the price is first agreed with the customer. This Au$1,000 threshold is based on the customs value, which means transport and insurance costs are not included when determining if it is considered a “low value” shipment.

[Note that this new regulation only affects Low Value imported goods - which were duty/tax free thus far. For goods that are over the Au$1000 customs value threshold nothing has changed - you will be charged for duties and taxes as it has been thus far.]

If you are a foreign merchant shipping merchandise to Australia, you will be required to create a secured credential called AUSid and register for GST with the Australian Taxation Office. Once you have registered for simplified GST, you will receive an Australian Taxation Office reference number (ARN). This is a unique 12 digit identifier (for example, 12 345 678 9012) used to identify you in our systems, and may be used as an identifier on invoices. Please send your ARN number to us as soon as it becomes available.

The rules concerning GST collection and payment are as follows (please refer to the ATO link at the end of this blog post):

- ATO will charge a merchant GST of 10% for all low value goods once they reach a threshold of Au$75,000 for the past 12 month period - Note that they will charge the GST on ALL shipments over the 12 month period once this threshold has been reached. As far as we know, this 12 month period starts on July 1, i.e. there is no retroactive taxation.

- If the foreign merchant is under the threshold via ALL shipping channels, then no GST is charged by ATO to the merchant for LVIG.

- Irrespective of whether you are over the threshold or under, it is good for the merchant to get an ARN. This is so there is no ambiguity or confusion if the ATO levies a GST.

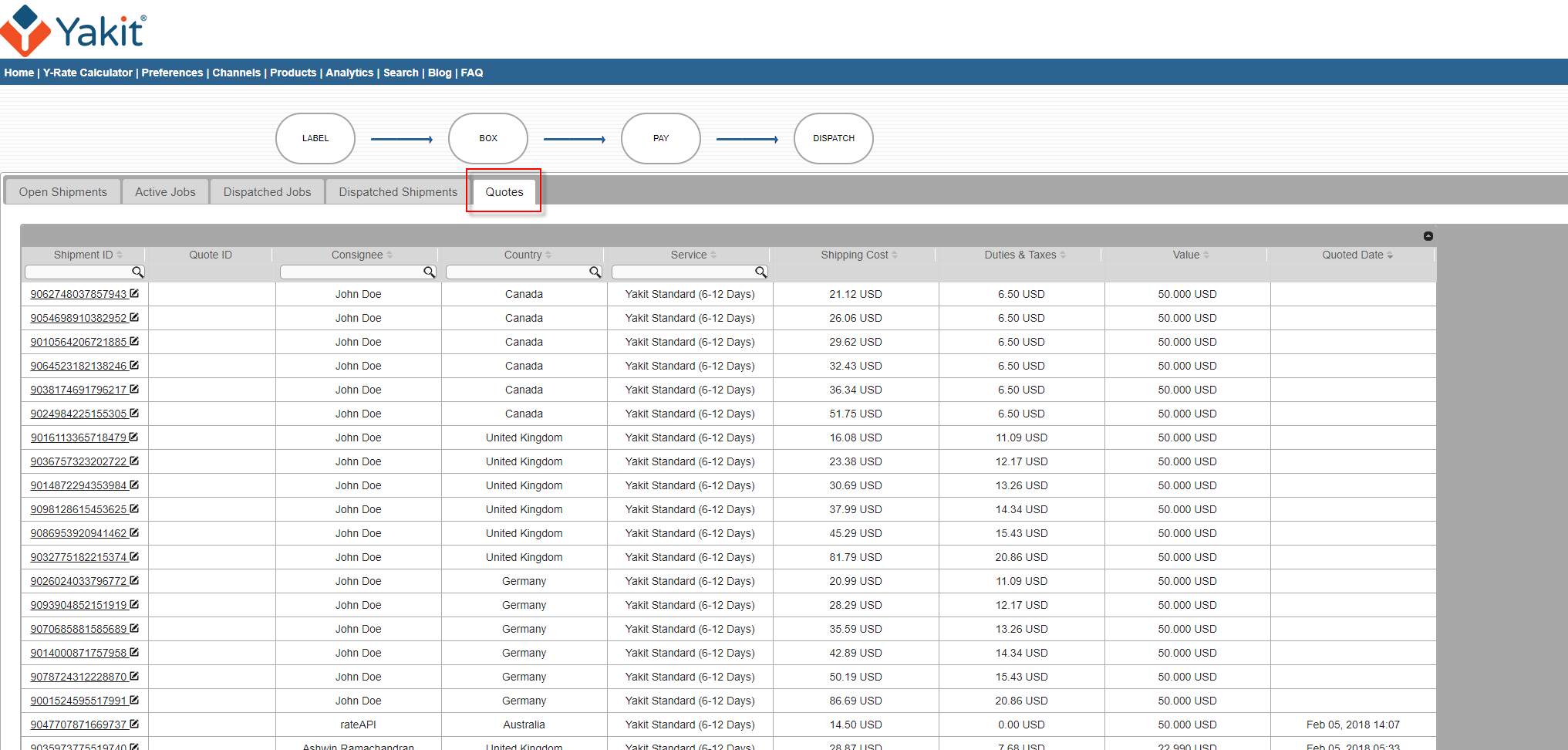

- The GST payment and negotiation is between the merchant and ATO. Yakit and its partners only ensure that the correct data is presented to Australia Customs for clearance.

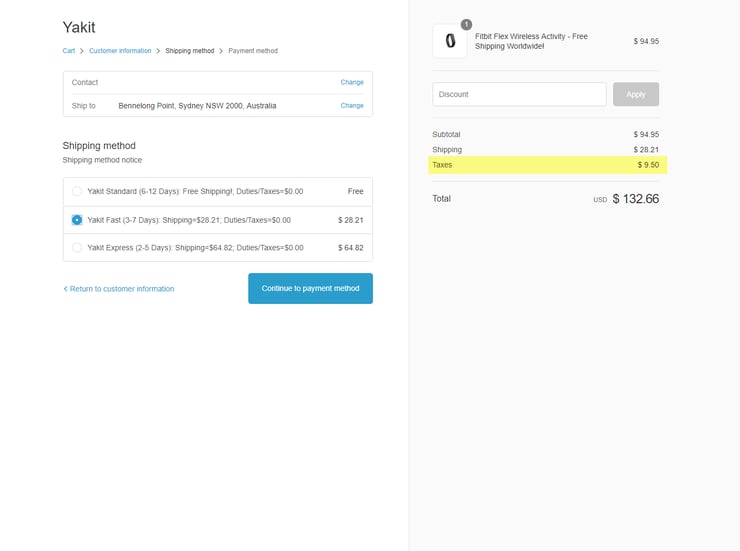

It is the foreign merchant's responsibility to report and collect the GST tax. The merchant can choose to charge GST on their items to their Australian buyers. Shopify merchants may charge GST on orders to Australia by doing the following.

1. In the Shopify admin, go to Settings -> Taxes.

2. Under Tax rates, click on Australia, add your desired Country Tax % and press Save.

3. Once this is done, the Tax will appear as a separate line in the customer's order cost breakdown.

For more information on how to create your AUSid and register for GST, click here.

For more information about the new Australian GST tax, click here.

As always, help is just a ![]() click away and we look forward to hearing from you.

click away and we look forward to hearing from you.